Property taxes are the major source of revenue. The base for property taxation is the assessment roll. It defines classes and types of properties which are subject to taxation. The assessment roll comes from the Municipal Property Assessment Corporation [MPAC]. The information included in this roll is then used to determine tax rates and to levy taxes. Tax rates are determined and taxes levied after Council adopts the annual budget of estimated revenues and expenditures.

Tax Contact Details:

For Property Tax inquires This email address is being protected from spambots. You need JavaScript enabled to view it.

For Tax Certificates This email address is being protected from spambots. You need JavaScript enabled to view it.

Phone 613-267-6500 Ext. 242

| 2026 Interim Installments are due | 2026 Final Installments are due |

|---|---|

| February 27 | TBD |

| April 30 | TBD |

Property tax billing occurs twice per year. Interim billing is sent out in January with installment payments due at the end of February and April. Final billing is sent out in June with installment payments due at the end of July and September.

For permanent and seasonal dwellings, add $210.00 for waste collection.The waste collection charge is included in the Final Tax Billing.

Please note that tax accounts that are two-years in arrears are eligible for further collection action such as tax sale registration. Payment plans are offered to assist residents to bring accounts into good standing. Please contact the tax department to make payment arrangements.

Tax Calculation

Taxes are calculated using the following formula:

Assessment x Tax Rate = Taxes

Tax Payments may be made by any of the following methods:

By Telephone/Internet Banking bill payment service through any of the Chartered Banks. To pay through internet banking, you have to use your roll number as your account. You can only use 15 digits, e.g. 919 000 00000 0000. You would log onto your bank site and query Drummond N or North be sure it ends in Taxes, it all depends how each bank sets up the payee. If you have any further questions please call the Township office and ask for Janet George or Angela Millar.

After Hours payments may be dropped off in the mail slot at the Township Office. (Please, no cash in the mail slot)

Pre-Authorized Monthly or Installment Payments - Print the form from our webpage. Fill out the form recording your Roll number. Attach a copy of a voided cheque or a printout from the bank and mail to the Township Office. We must receive the information before the 8th of the month as the payments are submitted to the bank on the 10th of the month and released on the 15th. Plans with a 1st of the month due date, are sent up to the bank 5 business days before the due. Normally the preauthorized monthly plan starts in November of each year based on 11 payments with a final payment the following October to clear the balance. You may still get on the plan later in the year but your monthly payments will be higher. The Installment preauthorized payment plan is also available; please submit the same form with your banking information. Payments are made in four installments which are the tax due dates on your tax bill. Please contact the office if you have any questions on how to fill out these forms.

You are responsible for any late payment penalties. Notice of Arrears due dates are upon receipt of the notice. Late payment penalties are applied on or about the 1st of each month.

Please be sure we have an updated mailing address. Canada Post no longer delivers to a RR # alone. Address changes must be in writing by regular mail, or by email.

Janet George, Tax Collector

613-267-6500 ext. 242

This email address is being protected from spambots. You need JavaScript enabled to view it.

Change of Address Form or Request to Discontinue Preauthorized Payments

It is the property owner’s responsibility to notify the Township Office of any changes. A change of address form is available by clicking here or a request to discontinue preauthorized payments form is available by clicking here. You can also contact the Township Office to request the above forms by email, fax or mail. As a security feature, the signature of the property owner is required for the office to process any such changes.

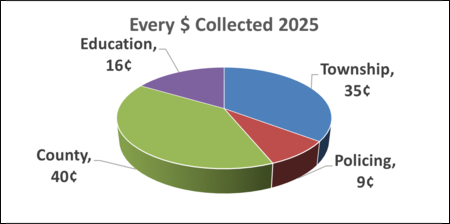

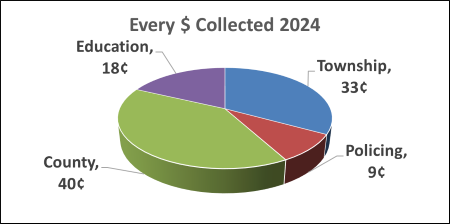

Property taxes are levied by the Township which provides the main source of revenue to deliver services supplied by the municipality. In addition to collecting its own taxes, the Township is also responsible for levying and collecting education taxes on behalf of the Province of Ontario, which are distributed to school boards located in the Township, as well as on behalf of the County of Lanark.

How Property Taxes are Calculated

To help provide clarity for property owners on how property taxes are calculated, including the link between property assessment, municipal service costs and required tax dollars, watch MPAC’s helpful and informative video.

When you receive your Property Assessment Notice, review it. No further action is required on your part unless you have questions or you disagree with your assessed value and/or classification.

Do you have questions about your Property Assessment Notice? Visit aboutmyproperty.ca or contact the Municipal Property Assessment Corporation (MPAC) Customer Contact Centre at 1-866-296-MPAC (6722), or 1-877-889-MPAC (6722).

If you would like to learn more about how MPAC assessed your property and compare it to others in your neighbourhood, visit aboutmyproperty.ca. You can also review market trends for your municipality and file a Request for Reconsideration. Your unique Roll Number and Access Key are included on your Property Assessment Notice.

| Property Class | RTC | 2025 Final Tax Rate includes: Municipal, County, Education | 2024 Final Tax Rate includes: Municipal, County, Education |

|---|---|---|---|

| Residential | RTEP/RTES/RTFP/RTFS | 0.01016244 + Local Charge $210.00 | 0.00976819 + Local Charge $210.00 |

| Commercial | CTN | 0.02470897 | 0.02398239 |

| Commercial Vacant | CUN | 0.02470897 | 0.02398239 |

| Industrial | ITN | 0.03065418 | 0.02965609 |

| Pipeline | PTN | 0.02612743 | 0.02533608 |

| Farmland | FTEP/FTES/FTFP/FTFS | 0.00254061 | 0.00244205 |